EA layoffs have reshaped this game publisher—and rattled the gaming industry—in a big way. Between 2023 and early 2025, nearly 1,900 jobs were cut across multiple studios, departments, and leadership levels. These weren’t isolated incidents. They were part of a larger pattern that reflects changing strategies, rising financial pressure, and shifting priorities inside one of gaming’s most powerful companies.

From the closure of Industrial Toys to deep cuts at BioWare, this article breaks down every major round of layoffs, analyzes the decisions behind them, and explores what they mean for developers, players, and the future of Electronic Arts.

Whether you’re following the business side of gaming or just want to understand what’s happening behind the scenes of your favorite franchises—this is the full story of EA’s recent upheaval.

Total EA Layoffs (2023 – 2025)

When you look at each layoff on its own, it might seem like part of routine restructuring. But when added up, the numbers tell a different story.

Between 2023 and early 2025, Electronic Arts cut an estimated 1,885 jobs across multiple studios, departments, and leadership levels.

Here’s how it breaks down:

- February 2023: 200 QA testers cut from Baton Rouge

- March 2023: 775 employees laid off (6% of global workforce)

- August 2023: 50 employees let go from BioWare

- February 2024: 670 employees laid off (5% of global workforce)

- January 2025: Over 100 BioWare staff laid off during restructuring

- Other cuts: Estimated 40 layoffs from the closure of Industrial Toys, and around 50 from Codemasters in late 2023

This brings the total to just under 1,900 employees laid off in two years—a number that reflects more than just financial caution. It shows a company constantly reshaping itself in response to missed forecasts, shifting priorities, and rising production costs.

While EA’s leadership framed many of these moves as efforts to “focus on what works,” the cost has been high—not just in headcount, but in lost creative momentum and internal morale. Longtime studios like BioWare were hit particularly hard, losing not just people, but decades of institutional knowledge and experience.

List of Key Electronic Arts (EA) Layoffs: 2023 – 2025 Breakdown

January 2023 EA Layoffs

The start of 2023 marked a turbulent period for Electronic Arts.

In January, the company shut down Apex Legends Mobile and Battlefield Mobile, two high-profile projects that were expected to carry EA’s momentum into mobile battle royale and FPS markets. This decision also led to the closure of Industrial Toys, the developer behind Battlefield Mobile.

This wasn’t just a move to cut costs—it signaled a shift in EA’s mobile strategy.

Apex Legends Mobile had shown promise with its initial launch, but engagement quickly dropped. Battlefield Mobile never even made it out of soft launch. EA pulling the plug this early highlighted how cautious even major publishers had become about mobile live service games in a post-IDFA world where user acquisition costs are rising and long-term retention is harder than ever.

February 2023: QA Team Cuts

On February 28, EA laid off 200 quality assurance testers at its Baton Rouge, Louisiana office. These QA professionals were primarily dedicated to Apex Legends, a flagship title for EA under the Respawn Entertainment label.

The move raised eyebrows in the industry, especially because it came with little to no warning for the workers.

According to multiple reports, affected employees were notified just hours before being locked out of systems. EA later explained that QA operations were being “expanded” to global teams—but to many, this looked more like an outsourcing shift masked as restructuring. It also raised larger concerns about how companies treat QA, a department often undervalued despite being critical to live-service games.

March 2023: Mass EA Layoffs

The biggest cut came in late March. On March 29, EA announced it would lay off 6% of its total workforce—around 775 employees. CEO Andrew Wilson described the layoffs as part of a “restructuring plan” to focus on EA’s “biggest opportunities,” including owned IPs and live services.

This round of layoffs reflected a broader tech and gaming trend: a post-pandemic correction.

Like many companies, EA had ramped up during the pandemic-era gaming boom, but as engagement slowed and economic pressures mounted in 2023, they were forced to realign.

At the time, EA also quietly canceled several unannounced projects. That’s a pattern we’ve seen across the industry—less risk-taking, more focus on safe bets. It’s not great news for innovation, but it’s how large publishers are choosing to weather financial uncertainty.

June 2023 EA Layoffs

June 2023 wasn’t marked by a mass layoff announcement, but by something arguably more impactful in the long run—a major internal reorganization.

EA CEO Andrew Wilson revealed the company would be split into two distinct divisions: EA Sports and EA Entertainment. Each unit would now operate semi-independently, reporting directly to Wilson himself. This move reshaped the structure of EA’s leadership and hinted at a deeper strategic shift in how the publisher wants to position itself moving forward.

Laura Miele, who previously served as both Chief Studios Officer and COO, was appointed President of EA Entertainment. On the EA Sports side, Cam Weber, formerly EVP and General Manager, took over as President. Familiar faces like Vince Zampella, Samantha Ryan, and Jeff Karp remained key figures within EA Entertainment, each continuing to oversee major franchises and studios.

While these changes were positioned as a way to streamline operations and “empower creative leaders,” they also came with a wave of executive departures. CFO Chris Suh left for another company, while Chief Experience Officer Chris Bruzzo announced his retirement. Both exits were effective by the end of the month.

Their replacements stayed in-house: Stuart Canfield, a 20-year EA veteran, stepped up as CFO after serving as SVP of enterprise finance and investor relations. Meanwhile, former CMO David Tinson took on the newly redefined role of Chief Experiences Officer.

At a glance, this restructuring might seem like routine corporate reshuffling. But it came at a time when EA, like much of the industry, was under pressure to become leaner, more focused, and more competitive. Splitting into EA Sports and EA Entertainment allowed for clearer prioritization and faster decision-making—especially important in a market where live services and sports franchises operate on entirely different rhythms.

And there’s a subtext here, too: this kind of restructuring often precedes more aggressive moves, including further layoffs or divestments. By creating two streamlined verticals, EA could more easily spin off or consolidate business units in the future, depending on financial performance.

August 2023 EA Layoffs (BioWare)

On August 23, EA confirmed it was cutting 50 jobs at BioWare, amounting to about 20% of the studio’s workforce. These weren’t minor positions—many of those affected had years of experience and had worked on some of BioWare’s most iconic franchises, including Mass Effect and Dragon Age.

This decision came as BioWare continued work on the long-anticipated Dragon Age: Dreadwolf, which has been in development since 2015. Layoffs during an active production cycle usually suggest internal pressure to ship faster or cut costs, which rarely bodes well for the final product.

Shortly after the layoffs, a group of former employees filed a lawsuit against EA, demanding better severance. That legal pushback reflected broader industry frustration with how large studios handle restructuring—especially when veteran talent is suddenly let go without what many would consider fair compensation.

December 2023 EA Layoffs (Codemasters)

In December, EA let go of an unspecified number of employees from Codemasters, the UK-based studio known for racing titles like F1 and Dirt. Though the company didn’t provide exact figures, reports pointed to a quiet but significant trimming of staff.

This followed disappointing sales and lukewarm reception to some of the studio’s recent games. It’s a pattern we’ve seen often: when performance slips, even well-respected legacy studios like Codemasters aren’t immune.

But more importantly, it raised questions about EA’s post-acquisition strategy. EA bought Codemasters in 2021 for $1.2 billion, hoping to dominate the racing game genre. Just two years later, the investment seemed to be under pressure, especially with Forza and Gran Turismo continuing to dominate console racing.

February 2024 Major EA Layoff

By early 2024, EA announced it would cut 670 jobs—around 5% of its global workforce. The move was part of a broader “refocusing” effort, and came alongside the cancellation of a promising first-person shooter set in the Star Wars universe.

That cancellation stung for fans and insiders alike. EA’s Star Wars games have generally performed well—Jedi: Survivor had been a critical and commercial hit just months earlier. But the decision to scrap this title wasn’t about quality—it reflected EA’s growing discomfort with licensed IP, and a desire to shift its energy toward original franchises it fully owns.

The reasoning was clear: owned IP means better profit margins, fewer creative constraints, and more control over long-term monetization. But it also means taking on more creative risk—and EA’s recent moves suggest they’re trying to thread that needle carefully.

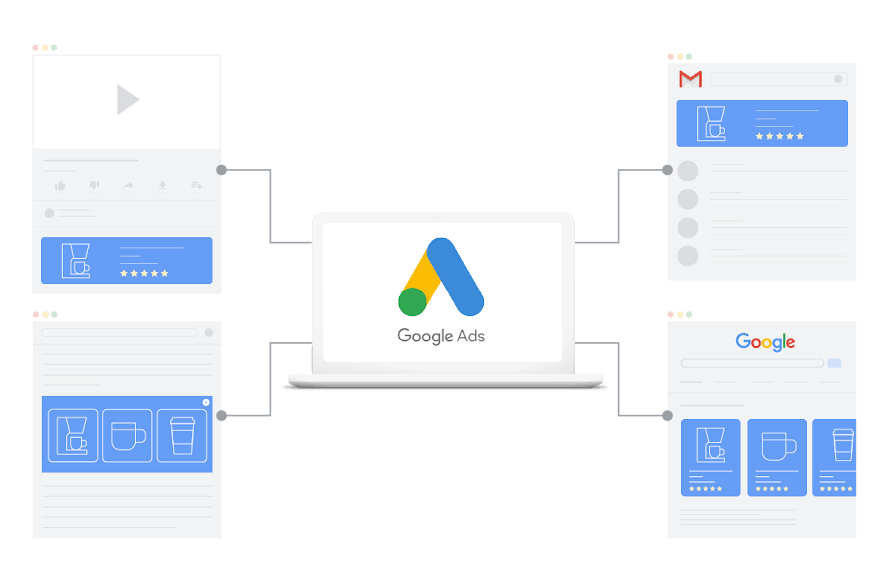

July 2024 Voice Actors Strike Over AI Use

In July, EA found itself on a different kind of frontline: the growing tension between AI technology and creative labor. SAG-AFTRA, the union representing voice actors and performers, launched a strike that included several top publishers—EA among them.

At the heart of the strike was a demand for protections against the use of AI to replicate actors’ voices or likenesses without consent. As studios explore using generative AI to cut production costs, voice actors are pushing back hard—insisting that their work is more than just data to be cloned.

EA didn’t initiate layoffs during the strike itself, but tensions were high across its studios. Projects slowed. Schedules shifted. And while the strike represented a broader industry issue, EA’s inclusion on the list of targeted companies showed how central they are to the debate about AI, labor, and the future of game development.

January 2025

The year opened on another rough note for EA.

In January 2025, the company revised its annual revenue forecast downward, citing underwhelming performance from two of its biggest releases: EA Sports FC 25 and Dragon Age: The Veilguard. According to Bloomberg, EA specifically “pinned most of the blame” on its soccer title, which failed to meet expectations despite being the flagship installment in the post-FIFA rebranding era.

This stumble hit especially hard. EA Sports FC was supposed to be a fresh chapter for EA’s most lucrative franchise, following the end of its decades-long licensing deal with FIFA. But fan feedback had already highlighted issues ranging from stale gameplay to monetization fatigue. Meanwhile, The Veilguard—once positioned as BioWare’s grand return—launched to middling reviews, with critics noting uneven pacing and a lack of innovation.

Later that same month, EA followed up the bad news with more layoffs. This time, it was BioWare again in the crosshairs.

The studio, which had already lost 50 employees in 2023, was downsized even further, shrinking from over 200 people two years ago to fewer than 100. According to PC Gamer, many of the studio’s remaining veterans were among those let go—a loss of creative leadership that raised serious concerns about BioWare’s future.

For longtime fans of franchises like Mass Effect and Dragon Age, this felt like the end of an era. Once a studio synonymous with rich storytelling and world-building, BioWare now seemed caught in a cycle of rebuilding and retreat. And with repeated layoffs, canceled projects, and key figures exiting, questions are growing louder about whether EA still sees BioWare as a core part of its long-term strategy—or just a name it owns.

Factors Contributing to Electronic Arts (EA) Layoffs

When nearly 1,900 jobs disappear in just two years, it’s not about one bad quarter or a single failed game. EA’s layoffs between 2023 and 2025 were the result of several overlapping challenges, both internal and industry-wide.

Post-Pandemic Market Correction

The pandemic boom gave gaming companies a huge, temporary surge in player engagement—and many, including EA, scaled up fast to meet that demand. But by 2023, that growth plateaued. Players returned to pre-pandemic habits, and spending slowed across live service and premium titles. EA wasn’t alone—Ubisoft, Riot, Microsoft, and others also announced significant cuts during this period.

But unlike some competitors, EA doubled down on restructuring, suggesting deeper financial pressure or an urgent need to refocus.

Live Service Fatigue

Games like Apex Legends, FIFA Ultimate Team, and The Sims have made EA billions, but live service fatigue is setting in. Players are getting tired of battle passes, seasonal grinds, and microtransactions that feel more obligatory than fun. This changing sentiment is making it harder for EA to sustain engagement—even in franchises that were once sure bets.

The cancellation of Apex Legends Mobile and an unannounced Star Wars shooter shows how hesitant EA has become to launch new live service projects, especially in mobile and licensed categories.

The Struggle with Licensed IP

For years, EA relied heavily on big-name licenses: FIFA, Star Wars, Marvel. But those deals are expensive, and they often limit creative control.

The shift away from licensed IP in 2024—marked by the cancellation of the Star Wars shooter—wasn’t just about saving money. It signaled a move to focus on franchises EA owns outright, like Battlefield, EA Sports FC, and Dragon Age.

But owning the IP comes with risk, too—if these games don’t hit, there’s no brand cushion to fall back on.

BioWare’s Ongoing Identity Crisis

No studio has been hit harder than BioWare.

Once a prestige name in RPG development, it has now gone through two rounds of major layoffs, shedding more than half its staff since 2021. Delays, leadership changes, and middling reception for The Veilguard have left BioWare in a difficult spot.

These cuts reflect more than poor sales—they represent EA’s struggle to figure out where single-player, story-driven games fit into its current model, especially when multiplayer and monetization dominate executive priorities.

Pressure from Shareholders and Forecast Misses

In both 2023 and 2025, EA missed revenue targets. Most notably, EA Sports FC 25 underperformed despite massive marketing and global reach. Investors don’t like surprises—and missing forecasted growth led to immediate restructuring, executive exits, and layoffs.

In a company as large as EA, a few missteps at the top can mean hundreds of jobs lost lower down the chain.

Emerging Tech and Labor Tensions

EA is also caught in the crossfire between rapid tech advancement and labor rights. The 2024 SAG-AFTRA strike over AI protections put the spotlight on companies like EA, who are exploring generative AI tools for voice, animation, and scripting.

While these technologies promise faster production and lower costs, they also raise ethical concerns and legal risks, especially when used without proper oversight or consent.

Impact of Electronic Arts (EA) Layoffs on the Gaming Industry

EA is one of the biggest players in gaming. So when it cuts nearly 1,900 jobs in two years, the shockwaves don’t just stay within its walls—they ripple through the entire industry.

Signal to Smaller Studios: Stability is No Guarantee

If a giant like EA—with multiple billion-dollar franchises—can’t maintain consistent staffing levels, what hope do smaller studios have?

For indie developers and mid-sized studios, EA’s repeated restructuring is a warning: even success isn’t always enough to protect jobs.

This creates a climate of uncertainty, especially as venture capital cools and publishers become more risk-averse. Developers are more hesitant to join live-service projects, mobile ventures, or experimental games knowing they could be shelved overnight.

Talent Drain from Legacy Studios

Repeated cuts at BioWare, Codemasters, and other long-standing EA-owned studios mean a massive loss of institutional knowledge. Many of the people laid off were veterans—creative leads, systems designers, narrative directors.

When that kind of experience leaves the building, it’s hard to rebuild. Games take longer to develop. Quality dips. Morale plummets. And fans can feel it. This is why franchises like Dragon Age feel adrift—they’ve lost the very people who once gave them their voice.

Growing Distrust Between Devs and Publishers

These layoffs also widen the trust gap between workers and executives. Despite record revenues in some quarters, EA continued to cut staff while spending heavily on marketing, licensing, and stock buybacks.

To many in the industry, it reinforces the idea that workers are disposable—even at the top.

This has pushed more devs to speak out, unionize, or seek out more sustainable paths like indie dev or co-op studios.

Caution Around Live Service Models

EA isn’t the only publisher backing away from mobile and live-service experiments, but it’s one of the most visible. The shutdown of Apex Legends Mobile and the cancellation of new live service shooters send a clear message: the model isn’t bulletproof anymore.

As UA costs rise and retention drops, more studios are beginning to rethink how—and whether—to build around long-term monetization. EA’s moves may accelerate this pivot across the industry.

Accelerating the AI Debate

The SAG-AFTRA strike and the growing use of AI tools by EA and other publishers have ignited a critical conversation about the future of creative work in gaming. EA found itself in the spotlight, not just for what it did, but for what it represented: a large, influential company pushing forward with AI adoption while workers pushed back.

How EA handles this tension going forward could set a precedent—good or bad—for the rest of the industry.

What’s Next for EA?

After two years of cuts, canceled projects, and missed expectations, EA is at a crossroads.

Internally, it’s now structured around two key verticals—EA Sports and EA Entertainment—with a clear focus on franchises it owns outright. The company is signaling a move away from high-risk licensed games and toward more controlled, scalable IP. That might mean fewer bold experiments, but also fewer expensive misfires.

Still, questions remain.

Can new EA games recover and rebuild player trust? And how will EA navigate the rising tension between automation, AI, and creative labor—without alienating the very people who make its games possible?

There’s also the matter of reputation. With BioWare now a shadow of its former self and developers burned by sudden layoffs, EA has work to do if it wants to rebuild trust—not just with players, but with talent. The success of its next few releases will matter, but just as important is how the company treats the people behind those games.

The industry will be watching. EA is still a giant. But whether it’s poised for a real comeback—or just trying to stay afloat—depends on what it does next.

Data Source

- Wikipedia, 2025. Electronic Arts

- CNBC, 2024. EA to lay off 5% of workforce, or about 670 employees

- PC Gamer, 2025. BioWare veterans confirm they were laid off by EA

Comments