The gaming industry is exploding. From mobile gaming to console, PC, and cloud, 2026 is shaping up to be one of the most exciting years yet.

Whether you’re a developer, publisher, or marketer, the shifts in player behavior, monetization models, and global market trends are impossible to ignore.

In this report, we’re breaking down the numbers, highlighting the biggest gaming trends, and sharing insights to help you stay ahead.

From skyrocketing market size projections to the platforms and genres taking the lead, here’s what you need to know about where the industry is headed—and how to ride the wave.

Gaming Industry Size & Growth

The global video game market remains massive and growing.

In 2024, worldwide gaming revenue reached about $187.7 billion, up ~2% year-on-year as the industry stabilized post-pandemic. (Newzoo, 2025)

For 2023, global revenues were roughly $184 billion (after a slight dip in 2022).

Industry forecasts expect 2025 to approach the $200 billion mark and $205 billion by 2026 as growth continues modestly. (Newzoo, 2025)

This makes gaming a larger market than even film or music.

Notably, 95% of game sales are now digital (downloads or streaming) versus just 5% physical, reflecting the ongoing shift to online distribution. (Trade.gov, 2024)

Gaming Industry Revenue by Platform

Mobile gaming is the largest segment by far – mobile games generated about $92 billion in revenue in 2024, 49% of the total market. Console games make up roughly 28% ($51B), and PC games about 23% (~$43B). (Newzoo, 2025).

Smaller but emerging segments include cloud gaming and VR/AR. Cloud gaming was estimated at $2.4B in 2022, and is projected to grow to $8+ billion in 2025 as the technology and content library mature. (Statista, 2024)

VR/AR gaming remains a niche (~5–10 million headsets sold annually), but new hardware launches) aim to boost its adoption.

Geographic Breakdown of the Gaming Industry

The United States and China are the top gaming markets by revenue. In 2023, the U.S. market generated about $46.7 billion, slightly ahead of China’s $44.6 billion. (Wikipedia, 2023)

Other leading countries include Japan ($18.4B), South Korea ($7.4B), Germany ($6.6B), and United Kingdom ($5.5B). (Wikipedia, 2023).

The U.S. alone accounts for roughly one-quarter of global game spending.

North America as a whole saw ~$50.6B in 2024 (+1.7% YoY). Asia-Pacific is the biggest region at $88.1B (led by China/Japan, though Japan’s spending fell 7% in 2024). Europe is ~$33.6B. (Newzoo, 2025)

These three regions drive the bulk of revenue, while Latin America and Middle East/Africa are smaller but growing markets (e.g. Turkey’s game spending jumped +28% in 2024).

Leading Gaming Companies in 2026

The gaming industry’s revenue is concentrated among a few giant gaming companies:

Sony Interactive Entertainment (Japan/U.S.)

PlayStation 5 hardware plus game software/services made Sony the world’s largest gaming company by revenue with $31B in revenue (latest fiscal year).

In recent years, the company reevaluated their strategy and went through significant restructuring. Learn more in our breakdown of Sony layoffs.

Tencent (China)

Tencent, with popular titles like Honor of Kings and stakes in many studios (earned ~$25.5B in game revenue recently).

Microsoft (U.S.)

Microsoft boosted by its Xbox business and the 2023 acquisition of Activision Blizzard, Microsoft’s game revenue was ~$21.5B prior to the merger. After buying Activision, Microsoft says it’s now the world’s #3 gaming company by revenue (behind Tencent and Sony).

Other Leading Companies

- Nintendo ($11.5B, driven by Switch consoles and first-party titles)

- NetEase ($11.5B, major Chinese publisher)

- Activision Blizzard ($8B, now part of Microsoft)

- Electronic Arts ($7.6B)

In the first half of 2023, the top 10 public game companies accounted for about 30% of total global game revenue, reflecting a fairly consolidated industry.

Gaming Industry Trends in 2026

Here’s what’s happening in the gaming industry, starting with mobile game market trends.

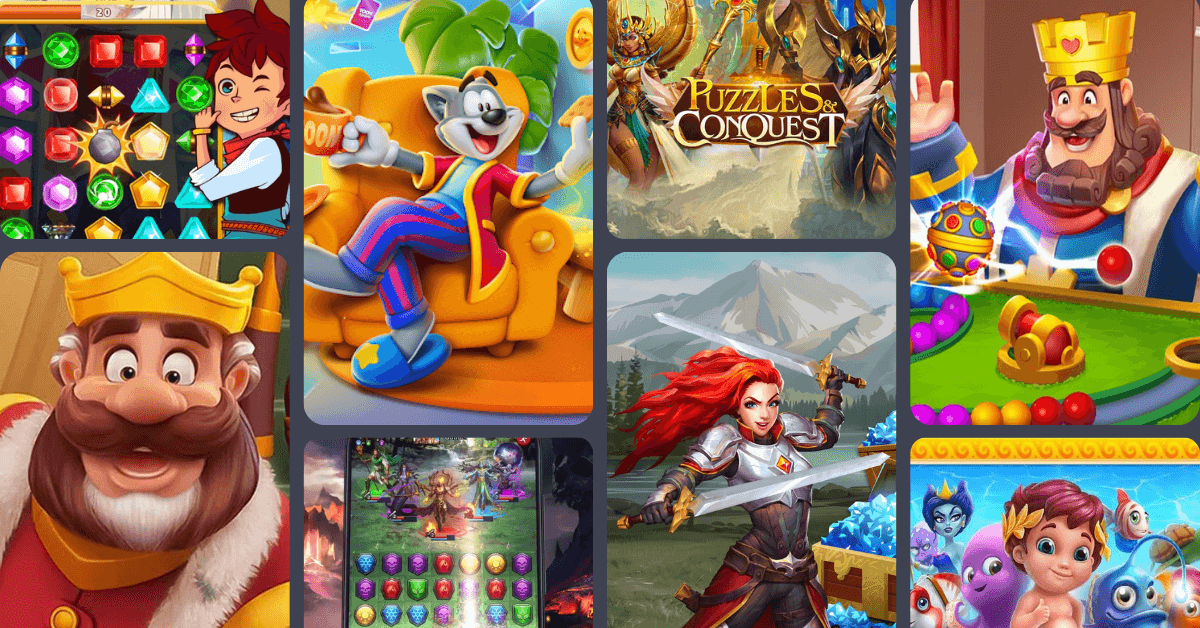

Mobile Gaming Trends

Mobile gaming continues to be the largest and fastest-evolving segment of the industry. Over 50% of the world’s 3.3 billion gamers play on mobile devices, thanks to the ubiquity of smartphones.

Top Mobile Genres

Casual and social games dominate download counts, while core genres drive spending. In 2024 the most downloaded mobile game categories were Simulation and Puzzle (each ~20% of downloads). (SensorTower, 2025)

However, by revenue, mid-core genres RPGs and Strategy games lead the pack, as these genres (think gacha RPGs, strategy war games) monetize heavily via in-app purchases. (SensorTower, 2025)

Casual puzzle games (e.g. Candy Crush) attract broad audiences, but mid-core titles like MOBAs and battle royales (e.g. Honor of Kings, PUBG Mobile) and casino/strategy games generate the highest spending per player.

Top Mobile Games

Tencent’s Honor of Kings remains the world’s highest-grossing mobile game, earning $13.25 billion total.

Other global top performers by all-time revenue include:

- PUBG Mobile ($9.01 billion)

- Candy Crush Saga ($7.69 billion)

- Monster Strike ($6.82 billion)

- Pokémon GO ($5.99 billion)

- Roblox($5.88 billion)

- Clash of Clans($5.86 billion)

- Coin Master($4.90 billion)

- Fate/Grand Order (English) ($4.81 billion)

- Fantasy Westward Journey ($4.78 billion)

- Genshin Impact ($4.57 billion)

New successes in late 2024 include Last War: Survival, which shockingly grew to $1.15B in revenue within a year.

These top games illustrate how a mix of Chinese MOBAs, Western casual games, and cross-platform sandboxes are dominating mobile revenue charts.

Mobile Game Market Growth Trends

While mobile gaming saw explosive growth during 2020–21, it cooled in 2022–23 due to IDFA privacy changes and a normalizing post-pandemic economy. 2024 showed a return to growth, and forecasts predict the mobile games market will continue expanding (~$103B by 2027). (Newzoo, 2025)

Emerging markets are a key driver – in 2024, countries like Turkey (+28%), Mexico (+21%), India (+17%) saw big jumps in mobile game consumer spending. In contrast, mature markets like the US and Europe were mostly flat, and Japan’s mobile revenue fell (~7%) amid economic challenges. (SensorTower, 2025)

Mobile Game Monetization

Mobile games largely rely on free-to-play monetization – a combination of in-app purchases (IAP), advertising, and subscriptions.

In fact, free-to-play titles generated 85% of all game revenue.

Successful mobile games typically use a hybrid monetization model (IAP plus ads).

However, this is shaped by platform policies.

Apple’s 2021 App Tracking Transparency (IDFA) changes (limiting ad targeting) hit mobile ad revenues and user acquisition, pushing developers to adapt with more contextual ads and Android-focused spend.

By 2024, the number of advertisers in mobile gaming had surged 60% YoY (to ~260k advertisers) as user acquisition efforts ramped back up. (SocialPeta, 2025)

On the platform side, Apple and Google’s app store rules (30% commission on purchases, required loot box odds disclosures, etc.) continue to impact monetization. Looking ahead, regulations like the EU’s Digital Markets Act could force Apple to allow third-party app stores in 2025, potentially shaking up the mobile app monopoly.

Console Gaming Trends

The new generation of consoles (Sony’s PS5 and Microsoft’s Xbox Series X|S) entered their mid-life in 2025 with strong sales momentum after early supply chain issues resolved. The PlayStation 5 crossed 50 million units sold by late 2023, outpacing the PS4’s adoption rate. (Sony, 2023)

The Xbox Series X|S is estimated around 20–25 million units sold, trailing the PS5 (roughly 1 Xbox for every 2 PS5s in key markets). Meanwhile, Nintendo’s Switch, now in its 7th year, reached 150+ million units lifetime– one of the best-selling consoles ever. By end of 2024, Switch shipments were ~150.8M, putting it in range of the all-time record (PS2 at 155M). (VGChartz, 2025)

Nintendo signaled the Switch’s successor is on the horizon, which could revitalize the console space.

Console software sales have been robust thanks to a packed slate of games in 2023. In the U.S., premium titles like Call of Duty, Madden NFL, and EA Sports FC routinely top charts.

Call of Duty: Modern Warfare III and Hogwarts Legacy (Warner Bros.) were among the best-selling games in 2023 in the U.S. by dollar sales.

Nintendo had amazing success, with The Legend of Zelda: Tears of the Kingdom selling 18+ million copies globally and new Mario titles boosting Switch game sales.

However, the console market in 2024 had fewer mega-releases than 2023, so much of the revenue came from ongoing sales of 2023 hits and live-service content.

Console hardware revenue grew in 2023–24 due to better availability of PS5/Xbox (PS5 was 2024’s top-selling console in the U.S. each month, often by a large margin).

Going into 2025, Sony and Microsoft’s strategies differ – Sony leans on big exclusive franchises (Spider-Man 2, God of War) to drive PS5, while Microsoft is investing in a content library (Game Pass) and integration of Activision Blizzard’s lineup (e.g. future Call of Duty titles on Xbox/PC Game Pass).

PC Gaming Trends

The PC platform remains strong with $40+ billion annual revenues. (Newzoo, 2025)

After a slight dip in 2022, PC game revenue grew ~+4% in 2024 (to ~$43B) as supply of GPUs improved and hit games like Baldur’s Gate 3 and Diablo IV drove spending.

Digital distribution on PC is dominated by Valve’s Steam, which continues to break usage records – in early 2025 Steam surpassed 40 million concurrent users online for the first time. (TechPowerUp, 2025)

Steam also reported 2024 as its highest revenue year ever.

Competing stores like Epic Games Store and others have a smaller share (Epic has tried to attract users with exclusive titles and free game giveaways). Epic’s strategy has been costly – the company spent hundreds of millions on exclusives and in late 2023 had to lay off 16% of its staff to cut costs.

Still, PC gamers benefit from healthy competition in storefronts and frequent deep discount sales.

Subscription & Services

Both console and PC gaming have seen a rise in subscription services. Microsoft’s Xbox Game Pass (which offers a rotating library of games for a monthly fee on console/PC) grew to about 34 million subscribers by early 2024. (Statista, 2024)

Sony revamped PlayStation Plus into tiered plans (adding an “Extra” game catalog akin to Game Pass). Multi-game subscriptions have somewhat plateaued in growth, however – Newzoo noted that the adoption of these services is slowing as the market saturates core users.

Meanwhile, individual games push their own “season passes” and subscriptions: e.g., Fortnite’s Crew subscription or World of Warcraft’s long-running monthly sub. For distribution, cloud gaming (playing high-end games via streaming) is emerging as a complement (see next section) but is not yet a primary platform for most players.

Cloud Gaming & Game Streaming

Cloud gaming services – which stream games to devices via the internet – made progress in 2024 but still face growth challenges.

The global cloud gaming market was about $2–3 billion in 2022 and is forecast to reach $8+ billion by 2025, impressive growth but still a small fraction of the $180B+ game industry. (Statista, 2025)

Services like Xbox Cloud Gaming (xCloud), NVIDIA GeForce Now, Amazon Luna, and PlayStation Cloud Streaming expanded support to more regions and devices.

By 2024, Microsoft reported over 10 million people had streamed games via Xbox Cloud Gaming (often as part of Game Pass Ultimate), and NVIDIA’s GeForce Now reached 25 million registered users.

Still, active user counts are likely a subset of those figures.

Service Updates

In 2023–2024, cloud providers formed notable partnerships.

To appease regulators during its Activision-Blizzard acquisition, Microsoft struck a deal to license out Activision’s games to other cloud platforms (e.g. NVIDIA’s) and agreed to transfer cloud streaming rights for Activision titles to Ubisoft in Europe.

This unusual arrangement means services like Ubisoft+ and GeForce Now can offer Call of Duty and other Activision games via cloud, aiming to prevent Microsoft from “cloud monopolizing” them. Google Stadia, once a prominent player, was officially shut down in January 2023 after failing to gain traction.

Its demise underscored the difficulty of the cloud model when exclusive content and user adoption are lacking. Amazon’s Luna and others have kept low profiles, focusing on incremental library additions and bundling (Luna is free for Prime subscribers for a rotating selection of games).

The Future of Cloud Gaming

The cloud gaming user experience is improving with faster internet and 5G, but challenges remain in bandwidth costs and game licensing.

Many gamers use cloud mostly as a secondary convenience (e.g. playing on a phone what would normally require a console/PC).

The Netflix of games vision is still nascent – even by 2025, cloud gaming accounts for <5% of industry revenue.

However, the entry of tech giants and integration with subscriptions (e.g. Xbox Game Pass Ultimate includes cloud play) means it will continue growing.

Notably, Netflix itself entered cloud gaming in late 2023, testing streaming of mobile/indie games to TVs and PCs for its subscribers. This could foreshadow bigger moves by non-traditional gaming companies leveraging cloud technology.

VR/AR Gaming Trends

The VR/AR market saw new hardware launches aimed at finally pushing immersive gaming into the mainstream.

Meta (Facebook) released the Meta Quest 3 headset in late 2023, offering improved mixed reality (pass-through AR) and graphics. Sony launched the PlayStation VR2 in early 2023 for PS5 with enhanced fidelity and controllers. Most notably, Apple released Vision Pro (an advanced AR/VR headset) in 2024, marking the company’s entry into spatial computing.

The Vision Pro’s high price ($3,499) and limited initial rollout target professionals and enthusiasts more than average gamers, but it brings new attention to AR/VR.

Despite these devices, VR adoption has been slower than hoped – global VR headset shipments fell ~12% in 2024 (the third straight year of decline).

About 9.6 million VR/AR headsets shipped in 2024, down from over 10 million in 2021.

The Quest 2 (2020) was the peak hit with an estimated ~20 million lifetime units, but newer devices haven’t yet surpassed that. Analysts expect a modest return to growth in 2025 (perhaps ~6–7 million VR devices sold in 2025 vs ~5.9M in 2024), especially if Apple’s entry spurs competition. (Statista, 2025)

VR/AR Software & Content

A few VR games continue to define the market. Beat Saber (a rhythm lightsaber game) remains VR’s best-selling title (well over 5 million copies sold) and a system-seller on Quest/PSVR.

Other popular VR games include Half-Life: Alyx (critically acclaimed shooter), VRChat/Rec Room (social experiences), and Resident Evil 4 VR. 2023 brought new VR entries like Horizon: Call of the Mountain (PS VR2) and Among Us VR.

However, no VR title has approached the revenue or player scale of top flat-screen games – the VR install base is simply too small.

AR gaming on mobile (like Pokémon GO) still attracts millions, but dedicated AR headset gaming is minimal (the Vision Pro’s launch lineup skews toward productivity and light games).

VR Market Size

Consumer VR content revenue is growing, but slowly – estimated at around $1–2 billion annually.

Many VR users play relatively short sessions.

A bright spot is location-based VR (VR arcades, theme park experiences) recovering after pandemic closures. In Japan and Korea, VR arcades drew crowds again in 2024.

The industry is also exploring mixed reality games that blend VR and AR – for example, Quest 3 can overlay game elements on your real room.

Overall, VR/AR gaming in 2025 is still in an early adopter phase.

Companies are investing for the long term, betting that continued tech improvements (lighter headsets, better motion tracking, wider 5G) will eventually yield a breakout moment for immersive gaming.

Monetization Models in the Gaming Industry

Monetization in gaming has become increasingly diverse and innovative across platforms.

Key trends in 2025 include:

Free-to-Play (F2P) Dominance

F2P games (which are free upfront and make money via in-game purchases or ads) generate the majority of revenue in the industry.

Almost all top mobile games and many PC/console/multiplatform titles (e.g. Fortnite, Genshin Impact) use this model.

These games monetize through sales of cosmetic items, playable characters, loot boxes, gacha pulls, etc.

The “whale” phenomenon – a small percentage of players contributing large revenues – continues to be important, so companies heavily analyze player data to personalize offers.

Battle Passes & Seasonal Content

The industry has broadly shifted away from randomized loot boxes (due in part to regulation) toward Battle Passes – tiered reward systems where players unlock content through gameplay each season.

Games from Fortnite to Call of Duty to mobile RPGs now offer passes that refresh every month or quarter.

This provides a steady stream of microtransaction revenue and keeps players engaged long-term.

For example, Fortnite’s seasonal Battle Pass (around $10) remains one of the best-selling SKUs every quarter, consistently driving revenue.

Battle passes are often supplemented by time-limited events, cosmetics collaborations (e.g. movie cross-overs), and DLC expansions to keep the content cycle (and spending) flowing continuously.

Subscriptions & Services

Beyond game-specific passes, many companies offer subscriptions.

Console makers have online service subscriptions (PlayStation Plus, Xbox Live Gold) which are effectively required for multiplayer on console – tens of millions subscribe, blending access and perks.

Game content subscriptions are growing: e.g. World of Warcraft’s longstanding $15/month sub, Final Fantasy XIV sub, or newer ones like EA Play (access to EA’s catalog) and Ubisoft+. On mobile, some games offer VIP monthly passes that give extra rewards.

Also, as noted, platform-wide subscriptions (Game Pass, PS Plus Extra) are a major value proposition, letting players access a library instead of buying games outright. Subscription revenues are now a significant part of the business model for publishers, smoothing the traditionally hit-driven income.

Advertising & Sponsorships

In mobile gaming, in-app advertising is a huge monetization stream – many free games show rewarded video ads or banner ads to players in exchange for bonuses.

Global mobile ad spend on games is billions annually, and ad rates (eCPMs) saw growth in 2024 as marketers returned post-IDFA slump.

Meanwhile, in esports and live streaming (see later section), sponsorship deals and ad impressions (Twitch ads, YouTube ads) indirectly monetize gameplay. Even console/PC games have dipped into advertising – e.g., Fortnite’s in-game concerts and brand tie-ins, sports games featuring real ads, etc.

However, gamers generally resist obtrusive ads in paid games, so this is mostly confined to free titles.

Premium Game Sales

Though F2P is king in revenue share, premium ($60–70) game sales are still crucial, especially on console and PC.

Single-player blockbusters and AAA franchises rely on upfront purchases (often with deluxe editions at higher price points).

Notably, average game prices ticked up to $70 for new AAA releases on PS5/Xbox Series X|S, reflecting increased development costs. Many premium games then layer on DLC or cosmetic microtransactions for additional monetization.

For instance, Call of Duty sells millions of $70 copies each year and runs an in-game store for skins.

Niche segments like indie games typically use a pay-to-own model at lower price points ($5–$40) on digital stores – the indie space thrives on volume and long-tail sales, often boosted by sales events and bundles.

Microtransactions & Regulation

Small in-game purchases (from $0.99 up to $99 bundles) are the lifeblood of many games.

However, governments are scrutinizing practices like loot boxes (random reward packs often akin to gambling).

Several countries in Europe (Belgium, Netherlands) have banned loot boxes in games or restricted them, forcing companies to alter game mechanics in those regions. In the U.S., there’s no federal ban yet, but bills have been proposed and the ESRB requires disclosures.

As a result, many western releases (e.g. Overwatch 2) removed loot boxes in favor of direct item shops or battle passes.

Monetization design now involves navigating such regulations – ensuring transparency, odds disclosures, and avoiding targeting minors with exploitative mechanics.

Industry-wide, there’s a trend toward “cosmetics-only” microtransactions (not pay-to-win) to maintain goodwill, though mobile gacha games still often blur that line.

In summary, the popular monetization strategies in 2025 are a mix of F2P microtransactions, season passes, subscriptions, and advertising, often blended together. A successful modern game might launch as a premium product but sustain itself with live ops monetization for years. The focus for companies is maximizing lifetime value of players while avoiding the most egregious practices that could prompt regulatory crackdowns.

Gaming Industry: Player Demographics & Behavior

Global Gamer Population: There are now over 3.3 billion video game players worldwide– about half of the world’s population! This number has climbed from ~2.7B in 2020 (pandemic boost) to 3.3B in 2024, and is expected to hit 3.5+ billion in 2025. (Priori Data, 2025)

Growth is driven by increased smartphone access in developing markets.

China alone is home to an estimated 700 million gamers, and India has well over 300 million (though mostly mobile players with low ARPU). The United States has about 190–209 million gamers (estimates vary) – roughly 61% of Americans play games at least. (Wikipedia, 2025)

In 2024, the ESA survey counted 190.6 million Americans (ages 5 to 90) who play at least one hour per week.

This widespread participation cements gaming as a mainstream hobby.

Gamer Demographics (Age & Gender)

The stereotype of gamers as teenage boys is long outdated.

The average gamer age in the U.S. is 36 years, and gamers span all age brackets. Thanks to mobile and casual games, seniors and kids are involved too – 2024 was the first time the ESA included children 5–17 in their survey data. (VentureBeat, 2024)

Nearly 70% of those under 18 play games, but so do upwards of 50% of people in their 50s. In terms of gender, gaming is almost evenly split: about 46% female, 53% male among U.S. players (with a small % identifying as non-binary). (VentureBeat, 2024)

Globally, the male/female split varies by region and platform – console and PC skew male (~70%+), whereas mobile gamers are often majority female (especially in casual genres). Notably, women drive a significant portion of mobile game revenue (e.g. women are more likely to make in-app purchases in certain genres).

The player base is also diverse in ethnicity and background: in the US, 19% of players are Hispanic, 12% Black, 8% Asian, roughly mirroring the population. (VentureBeat, 2025)

Gamer Device Preferences

Many gamers now play on multiple platforms. Mobile is the most common gaming device, since nearly anyone with a smartphone can be a “gamer”.

PC gaming is popular in Asia and Eastern Europe, while console gaming is strong in North America, Europe, and Japan. In the U.S., for example, 70% of players game on smartphones, ~50% on consoles, and ~40% on PC (with overlap) according to recent surveys.

The ubiquity of cross-platform titles (Fortnite, Minecraft, etc.) means many players switch between, say, a console and a mobile version.

The “hardcore” segment (enthusiast PC and console players) might spend thousands on rigs or multiple consoles, while a casual mobile player might stick to one device.

Cloud gaming aims to blur these lines further by letting players use any screen, but as noted its usage is limited so far.

Gaming Time & Habits

The average time spent gaming has increased somewhat in recent years but varies by demographic.

In the U.S., about 28% of adults play 1–5 hours per week, 25% play 6–10 hours, and ~8% admit to 20+ hours/week sessions. (Statista, 2025)

Youth generally play more hours per week than older adults.

One survey found U.S. gamers aged 18–24 average ~12 hours/week, whereas those 45+ average ~5 hours/week.

Globally, some markets are extremely engaged – for example, a typical Chinese gamer under age 30 might play 10+ hours of mobile games a week (despite government curfews on minors), and hardcore PC gamers (e.g. in South Korea or Russia) might spend several hours per day in competitive games.

Mobile gaming has broadened play occasions: many people play in short bursts throughout the day (on commutes, lunch breaks, etc.), which can total many hours over a week.

Daily playtime of an hour or more is now common across all platforms.

Player Motivations

Surveys consistently show that players value gaming for entertainment, relaxation, challenge, and social connection.

In a 2024 ESA report, 93% of players said video games provide stress relief and mental stimulation. Many adults describe gaming as a way to unwind after work, analogous to watching TV.

Socially, gaming has become a key way friends and family connect – whether it’s kids playing Minecraft together or adults in different cities chatting over Call of Duty Warzone. The ESA noted that older gamers often have nostalgic motivations, introducing their children to games they loved.

During the pandemic, gaming’s social aspect was especially highlighted, and that stuck: multiplayer and co-op titles remain hugely popular.

On the other hand, some player motivations differ by demographic: younger players might seek competition and mastery (leading to the popularity of esports titles), whereas many mobile players seek simple “time-killers” or light cognitive challenges (hence the success of puzzle and word games).

The unifying theme is that gaming is a core leisure activity across age groups, and it’s here to stay – as the ESA CEO said, “video games are a lifelong source of entertainment… not just a childhood hobby”.

Gaming Industry Development Trends

Game development in recent years has been marked by tighter budgets for non-AAA titles, developer layoffs, and the increasing use of AI.

Here’s what’s going on in 2026.

Game Engines & Tools

Modern game development is dominated by a few powerful game engines. Unity and Unreal Engine together are the foundation of a huge portion of games.

Unity (popular for its ease-of-use and multi-platform support) is used by the majority of mobile games and many indie/AA games.

Unreal Engine 5 (by Epic Games) is preferred for high-end graphics and large-scale games, especially AAA console/PC titles.

Both engines have seen widespread adoption – for instance, over 70% of new mobile games use Unity, while many next-gen console games (from Fortnite to the upcoming Hellblade 2) run on Unreal.

An important 2023 development was Unity’s attempted change to its pricing/runtime fee, which sparked outrage among developers and led some to consider Unity alternatives (Unity partly walked back the changes).

This debacle gave a boost to open-source and niche engines like Godot and GameMaker, with thousands of indie devs experimenting with Godot in late 2023 as a protest.

Still, Unity and Unreal remain firmly entrenched going into 2026.

We also see big publishers using their own internal engines less – even studios like Square Enix and CD Projekt are moving to Unreal Engine for efficiency. Cross-platform portability is a key goal: engines now make it easier to ship games on console, PC, and mobile with one codebase, which is critical as cross-play becomes expected.

AI in Game Development

The past year has seen an explosion of interest in generative AI and its applications in game dev. Nearly three-quarters of game developers say they are excited about AI’s potential for creating game content.

Procedural generation isn’t new (games have auto-generated levels for decades), but now AI can assist in creating art, writing dialogue, generating code, and even designing gameplay.

For example, Ubisoft’s Ghostwriter AI tool uses AI to draft NPC dialogue barks (saving writers time on filler lines). Smaller studios are using tools like GPT-4 to generate lore text or item descriptions.

There’s experimentation with AI-driven NPCs: instead of pre-scripted lines, NPCs can use an LLM (large language model) to respond dynamically to player input. Early demos (e.g. a game “Retail Mage” with AI shopkeeper NPCs) show promise in making game worlds feel more alive.

However, AI integration is in its infancy – challenges include controlling AI output to avoid inappropriate content and the computational cost of running AI for many characters.

In 2024’s GDC (Game Developers Conference), “AI in games” was a hot topic, with talks on using AI for quality assurance (bug finding bots), level design suggestions, and artwork upscaling.

Studios like NCSOFT and NetEase have invested in R&D for fully AI-driven games, but in practice 2026’s big releases will still be largely hand-created, with AI as a helper in the toolbox.

One area we already see AI broadly used is in testing – developers run AI agents through game levels to find exploits or glitches, augmenting traditional QA teams. Over the next few years, expect selective use of AI in gaming to become standard (for efficiency in asset creation and coding), even if AI hasn’t yet revolutionized gameplay itself at scale

Production Scale & Budgets

AAA game development has reached Hollywood blockbuster levels of investment.

Top-tier games now often have budgets exceeding $100 million, sometimes up to $200–300M (including marketing).

For example, 2023’s The Legend of Zelda: Tears of the Kingdom reportedly had a team of hundreds over 5+ years, and Grand Theft Auto VI is rumored to be one of the most expensive productions ever.

The result is that big publishers are risk-averse – Newzoo noted that studios are “avoiding new IPs” in favor of sequels and established franchises, to ensure these massive budgets pay off.

At the same time, the indie scene is flourishing with relatively small budgets.

Tools like Unity/Unreal, digital distribution, and middleware (for audio, physics, etc.) let indie teams of just a few people create games that can become global hits (Stardew Valley, Among Us, etc.).

The cost spectrum is wide: an indie PC game might be made on $50k–$500k, a AA game on $5M–$20M, and a AAA on $50M+ (often much more).

Outsourcing and globally distributed development are also standard now – art assets and programming tasks are frequently contracted to studios in Eastern Europe, Latin America, South Asia, etc., making game development more international than ever.

However, 2023’s economic tightening led some studios to cancel projects and lay off staff (over 10,000 game developer jobs were cut in 2023 alone), which means many teams in 2025 are trying to do more with fewer resources.

(For a full breakdown of layoffs, check out our Gaming Industry Layoffs article)

Cross-Platform & Cross-Play

Developers are increasingly building games to be cross-platform from day one, reflecting the market reality. Major franchises like Call of Duty, Fortnite, Minecraft, Roblox, etc., set consumer expectations that progress and friends lists carry across PC, console, and mobile.

In 2026, even many indie games use engines that allow deployment to multiple platforms with minimal changes.

Genshin Impact (an open-world RPG) showed that a high-fidelity game can run on PC, console, and mobile concurrently.

This has fueled demand for robust cross-play support – by now, almost all major multiplayer games offer cross-play, unless restricted by platform policies. Developers use services like Epic Online Services or custom solutions to enable this.

One challenge is ensuring fair balance (e.g. PC mouse players vs. mobile touch players), which some games solve by input-based matchmaking. Another challenge is certification and storefront differences across platforms, which can slow simultaneous updates – but here, too, tools have improved.

Middleware SDKs and engine integrations help abstract platform specifics. The push for cross-platform releases has also made porting older games to new platforms a big business (e.g. many PlayStation exclusives like The Last of Us or God of War have been ported to PC to reach wider audiences).

So essentially, the development mindset in 2026 is “build once, play anywhere”, which benefits players and can significantly increase a game’s addressable market.

Esports & Creator Economy

Competitive gaming is now an established part of the industry, though 2024 brought a mix of record viewership and financial challenges. League of Legends remains the premier esport globally – the LoL 2024 World Championship (Worlds) set a new record with 6.94 million peak concurrent viewers during the finals. (EsportsCharts)

Worlds 2024 was a cultural event, complete with a K-pop opening ceremony that drew 4.2M viewers itself. (EsportsCharts)

Other top esports by viewership in 2024 included CS:GO (the last CS:GO Major in May 2023 peaked around 1.5M viewers; Counter-Strike 2 launched late 2023 and will carry the torch), Dota 2, Valorant, Mobile Legends: Bang Bang (hugely popular in Southeast Asia), and PUBG Mobile.

Notably, Dota 2’s The International 2024 saw a steep drop – its prize pool was slashed to ~$3M (from $18M+ the year prior) and peak viewership was 1.5M, the lowest in a decade. (EsportsCharts)

This was due to Valve removing the crowdfunding approach that had once made TI prize pools $40M+. In contrast, LoL Worlds and Valorant Champions continued to have multi-million dollar prize pools backed by Riot and partners ($2M for LoL, $1M for Valorant) and healthy audience growth (Valorant’s 2023 championship hit 1.4M peak viewers).

Fortnite re-emerged with an in-person World Cup in 2024, though scaled down compared to its 2019 event, and games like Rocket League, Overwatch, and Call of Duty held championships with more niche but dedicated audiences.

Financial Health of Esports

The esports audience is still growing – there were an estimated 318 million “esports enthusiasts” worldwide in 2025 (up from 215M in 2020). (Statista, 2025)

However, esports organizations and leagues struggled financially through 2023–24.

Many esports teams that expanded rapidly on venture capital are now facing reality: revenues (from sponsorships, media rights, merchandise, etc.) have not caught up to expenses (player salaries, franchise fees, production costs).

This led to a wave of layoffs and pullbacks.

For example, 100 Thieves and FaZe Clan downsized staff, TSM (Team SoloMid) departed several esports (including selling its League of Legends championship series slot) amid profitability concerns, and multiple Overwatch League teams disbanded.

Even game publishers scaled back: Activision Blizzard effectively ended the Overwatch League’s original model in late 2023, offering teams a payout to dissolve the league format after years of low viewership and expensive slots. Activision’s esports staff was reportedly cut down to just 12 employees after these changes.

Riot Games also had layoffs impacting esports and live events staff. The result is that 2025’s esports ecosystem is in a correction phase – the days of blank-check investments are over, and companies are seeking sustainable models. That means fewer but more meaningful events, cost-sharing with game publishers, and focusing on content creation around esports.

Prize Pools & Sponsorships

Total esports prize money actually declined with The International’s change. Outside of LoL and Dota, most games have relatively modest prize pools (six or low seven figures).

Top players in games like Dota 2 and CS:GO have earned career totals in the millions, but for many pro players, salaries (paid by teams) are the main income, not tournament winnings.

Those salaries too are being reined in – several League of Legends teams in North America reportedly discussed salary caps as spending had grown unsustainable.

Sponsorship is still the biggest revenue source for esports orgs, but some big sponsors pulled back in 2023. For example, crypto exchanges like FTX that had been big spenders collapsed, and non-endemic brands have been harder to secure amid economic uncertainty.

On a positive note, 2024 did see new sponsorships in regions where esports remains very popular – Chinese brands heavily sponsor Honor of Kings and League teams, and Southeast Asia’s Mobile Legends league has strong telecom sponsors.

There’s also experimentation with white-label production: esports companies like ESL are partnering with game publishers to run official events (e.g. Fortnite’s 2024 LAN was operated by DreamHack/ESL).

Creator Economy (Streaming & Content Creation)

The ecosystem of content creators – streamers on Twitch, YouTube, etc. – is a vital part of gaming culture and marketing.

Twitch remains the dominant live-streaming platform with around 61% of total watch time in 2024.

Over 20.3 billion hours of content were watched on Twitch in 2024, showing slight growth from the prior year. YouTube Gaming is the second-largest for game streaming (particularly for Southeast Asian and mobile audiences, and for VOD content).

A big development was the rise of Kick, a new streaming platform launched in 2023 with an ultra creator-friendly revenue split (95% to streamers). By mid-2024, Kick had lured several high-profile streamers (such as xQc and Amouranth) with multi-million dollar deals.

Kick’s viewership climbed fast – it amassed 2.1 billion hours watched in 2024, about a 6% market share of live gaming content. This came largely at the expense of Twitch’s share (which dipped from ~72% in 2022 to ~61% in 2024).

Twitch in 2023 also made some controversial policy moves (like proposing stricter rules on sponsored content, then backtracking after backlash), which, combined with its 50/50 revenue split for most streamers, made emerging rivals attractive.

Nonetheless, Twitch’s community and scale keep it on top, and it hosted peak concurrent audiences over 3 million for events like the 2024 League Worlds co-streams.

Creator Monetization

Streamers and gaming video creators earn money through a mix of platform revenue and outside deals.

On-platform: Twitch subscriptions (fans pay ~$5/month to sub, of which creators typically get 50%, or 70% for top partners), Bits/Stars (one-off donations), and ad revenue (Twitch and YouTube split ad revenue ~50/50 with creators).

YouTube offers similar monetization (channel memberships, Super Chat donations, ad share).

Kick, by contrast, offers a 95/5 split on subscriptions and has even paid some creators 100% of sub revenue as a promotion. This competition has led to better terms for creators across the board.

Off-platform: many creators’ biggest income comes from sponsorships (e.g. being paid to promote a game, energy drink, or VPN on stream) and merchandise sales.

The “creator economy” around gaming is robust – for example, top streamer Ninja reportedly earned over $500k per month at his peak from combined sources, and even mid-level streamers often make a comfortable living.

In 2024, we’ve seen more integration of affiliate marketing in streams (creators have store pages on Amazon or the Steam Creator Program to get kickbacks when viewers buy games). Also, platforms like Twitch introduced bounty boards where streamers can accept deals to play certain games for a set fee.

Trends in Game Streaming Content

Game streaming content has diversified beyond just esports and big titles. Variety streamers who entertain with personality-driven content are as popular as ever.

The role of VTubers (virtual avatar streamers) has grown, especially on YouTube – talent agencies like Hololive and Nijisanji manage anime-avatar streamers who collectively pull millions of views (the top VTubers are as popular as top flesh-and-blood streamers).

In the West, VTubing is more niche but growing too on Twitch.

Short-form video (TikTok, YouTube Shorts) has also become a key avenue for gaming content discovery; many streamers use clips on TikTok to funnel viewers to their live streams.

Creators and Game Development

The influence of content creators on game success is undeniable.

Many developers now release creator modes or replay editors in games to encourage shareable moments. Games like Among Us or Goose Goose Duck became hits largely due to streamer adoption.

Recognizing this, publishers often give early access to streamers/YouTubers as a marketing strategy.

In 2026, expect that essentially all major multiplayer games will have a content creator outreach strategy.

There’s also a symbiosis with esports – popular streamers co-streaming official esports events have boosted viewership (Riot allows co-streaming of LoL and Valorant events with certain creators, expanding reach).

The creator economy side of gaming continues to grow in monetary terms as well: according to Stream Hatchet, total live-streaming hours watched grew ~12% in 2024 to 32.5B hours, reversing a slight dip in 2022.

This indicates that post-pandemic, people are still tuning in en masse to watch others play, making content creation a durable pillar of the industry.

Gaming Industry Regulation Challenges

The gaming industry has faced many government regulation challenges, policy changes, and antitrust concerns.

Here’s what you need to know.

Gaming Industry Government Regulations

With gaming’s cultural prominence comes greater regulatory scrutiny. One ongoing area is loot boxes and gambling-like mechanics.

Countries such as Belgium and the Netherlands enforce outright bans on loot boxes in games (titles like FIFA had to disable loot box packs there) – a trend that could spread.

In the UK, after pressure, the industry opted for self-regulation (enhanced parental controls and disclosures) to stave off a ban.

China continues its strict approach: Since 2021, China limits under-18 gamers to only 3 hours per week of online gaming and enforces real-ID registration.

This has significantly impacted game studios targeting China – e.g., Tencent had to restructure its games to comply, and youth engagement dropped (though some minors evade the rules).

Privacy laws like Europe’s GDPR and California’s privacy act affect games too, requiring clear consent for data usage and strong protections for underage players (COPPA in the US mandates parental consent for under-13 data collection).

This is forcing developers to be careful with behavioral tracking and chat data.

Another regulatory front is content moderation and online safety: the EU’s Digital Services Act (effective 2024) will require larger online games/platforms to more aggressively police hate speech, harassment, and extremism on their services. This could mean more investment in moderation for games with user-generated content or chat.

App Store Policies and Antitrust

The dominance of Apple’s App Store and Google Play in mobile gaming has been challenged both in courts and by new laws.

The high-profile Epic Games vs. Apple antitrust lawsuit (spurred by Fortnite’s ban in 2020) concluded with mixed results – as of 2023 Apple largely prevailed, but was forced to allow developers to inform users of alternative payment options.

More impactful is the EU’s Digital Markets Act (DMA), which made Apple to permit third-party app stores and sideloading on iOS in the EU.

App store commission rates themselves face pressure; Google lowered its cut to 15% for the first $1M earnings of small developers. Also, both Apple and Google have updated policies around subscriptions cancellation (making it easier to cancel) and loot box transparency, influenced by regulatory and public pressure.

Labor and Unionization

The game industry historically had little union presence, but that is changing.

Over 2022–2024, a wave of game developer unionization efforts took place. In 2023, Sega of America’s staff voted to form a union of ~200 employees, the largest multi-department game union in the US.

Prior to that, QA teams at Activision Blizzard’s Raven Software and Blizzard Albany studios unionized (under the Communications Workers of America), as did QA staff at Microsoft’s ZeniMax – Microsoft actually voluntarily recognized that union, a first for a major gaming firm.

These unions seek better pay (QA testers are often low-paid), more reasonable hours, and job security in an industry known for crunch and cyclical layoffs.

The trend extends overseas as well: game worker unions exist or are emerging in the UK, Canada, and Japan.

Another labor front was with voice actors and performance capture artists: In late 2023, the SAG-AFTRA union for actors was in negotiations with major game publishers for a new contract, including protections against AI voice replication. By early 2024, a tentative agreement was reached that gave voice actors some raises and limited use of AI without consent.

The broader theme is that game development is maturing as an employment sector, with workers organizing to improve conditions – a reaction to notorious issues like 80-hour crunch weeks and mass layoffs. Studios will need to adapt to working with unions for the first time, and factor in potentially higher labor costs and more structured schedules.

Industry Consolidation & Antitrust Concerns

The past few years saw unprecedented consolidation, raising antitrust questions.

The biggest example is Microsoft’s $68.7 billion acquisition of Activision Blizzard, announced in 2022 and completed in October 2023.

Regulatory bodies scrutinized this heavily – the U.S. FTC sued to block it (but Microsoft won in court), and the UK’s CMA initially blocked it, only relenting after Microsoft agreed to concessions (like offloading cloud rights).

With the deal closed, Microsoft now owns franchises like Call of Duty, Warcraft, Diablo, Candy Crush, etc., causing concern about too much content under one roof.

Microsoft argued it still trails Tencent and Sony in revenue, but regulators signaled that any further large acquisitions by big players will face steep hurdles.

Other mergers: Take-Two bought mobile giant Zynga for $12.7B in 2022, Sony bought Bungie (Destiny’s developer) for $3.6B, EA attempted a merger (rumors with NBCUniversal) that didn’t materialize, and Saudi Arabia’s Public Investment Fund has invested in many companies (e.g. owning 8% of Nintendo).

The consolidation trend raises questions of monopolies in certain genres or distribution channels.

We may see more antitrust investigations if, say, exclusivity deals end up harming competition.

As of 2026, legislators in the U.S. and EU are keeping a closer eye on Big Tech’s play in gaming – for instance, the EU is investigating whether Microsoft will honor commitments to keep Activision games like CoD multiplatform for 10 years.

In the U.S., some politicians floated the idea of re-examining the Apple/Google app store duopoly under antitrust law, which could benefit the likes of Epic Games.

Other Challenges

The gaming industry also contends with issues such as content moderation – games with user content have to police toxicity and hate speech, an ongoing battle.

Intellectual property disputes is another issue (e.g. the legality of game mods, or debates over who owns streaming content – some publishers tried to claim ad revenue from streamers, sparking community blowback).

Games also sometimes get caught in geopolitical tensions, like Blizzard’s 2019 Hearthstone incident or more recent requirements to scrub content for Chinese approvals).

Developers must navigate cultural sensitivities in a global market – for example, Fortnite had to make a special China-only version to comply with strict rules (though it was shut down in 2021 when China’s crackdown intensified).

Lastly, the industry is addressing accessibility and inclusion: there’s growing advocacy for making games playable for people with disabilities (and some regions like the EU have guidelines requiring digital products be accessible). These aren’t legal mandates everywhere, but they are part of the evolving “social contract” of game companies with their massive audiences.

Final Thoughts on the Gaming Industry in 2026

Overall, the gaming industry in 2026 is immense in scale and still growing, yet faces a period of adjustment and maturation.

The U.S. market remains a leader in revenue and innovation, but global influences (from Asia’s mobile-first approach to Europe’s regulatory environment) are increasingly shaping the future of games.

With new technologies like cloud and AR/VR on the horizon, and structural shifts in how games are made and monetized, the industry is poised for an exciting yet challenging year ahead.

Data Sources

- SensorTower, 2025. State of Mobile 2025 Report

- Trade.gov, 2024. Video games sector

- Statista, 2025. Global gaming revenue and platform breakdown

- Epyllion,2025. The State of Video Gaming 2025

- Newzoo,2025. Global Games Market Report

- Statista, 2025. Mobile Gaming in 2025 and Beyond

- Sensor Tower, 2025. Mobile game revenue and genre insights

- Wikipedia, 2025. Video Game Industry Overview

- AppMagic, 2025. Casual Games Report

- AppMagic, 2025. Top Mobile Games and Publishers

- SocialPeta, 2025. Global Mobile Games Marketing Trends

- GameAnalytics, 2025. Benchmarks, 2025

- eMarketer, 2025. Digital Gamers 2025

- eMarketer, 2025. Mobile Gaming 2025

- Venturebeat, 2025. Mobile Gaming Revenue is Up, 2025

- Sony Interactive, 2023. PlayStation 5 Surpasses 40 Million in Sales

- Circana (formerly NPD Group). S. game and console sales rankings

- Steamworks / Valve. Steam usage statistics

- Microsoft Investor Relations. Xbox Game Pass subscriber counts & Activision acquisition details

- Sony Group Investor Relations. PlayStation revenue reports

- Counterpoint Research – VR headset shipment data

- Pew Research Center. Gaming habits across age and gender groups

- Unity Blog. Runtime Fee policy update 2023–2024

- Esports Charts. Esports tournament viewership stats

- FTC / U.S. Federal Trade Commission. Microsoft–Activision antitrust filings

- European Commission / CMA (UK). Digital Markets Act, App Store policies

- SAG-AFTRA. Voice actor strike & AI contracts

- CWA / Game Workers Alliance. Unionization efforts

- The Game Awards. Annual event announcements and viewership

- Acquisition & studio closure coverage

- VGChartz, 2025. PS5 vs Xbox Series X|S Sales Comparison in the US

- TechPowerUp, 2025. Steam Breaks its Own Record: 40 Million Concurrent Users Online

- Priori Data, 2025. How Many Gamers Are There in 2025

- VentureBeat, 2024. 61% of Americans, or 190.6M people, play video games