2023 was a major moment for the mobile gaming industry. It was a year of change and adaptation. The casual games market, in particular, has seen a whirlwind of changes.

The pandemic-induced surge in mobile gaming spending faced a slowdown as inflation hit in 2022.

Game developers, in response, shifted their sails.

Instead of rapid scaling, the focus shifted to steady revenue growth and long-term profitability.

But what does this mean for mobile game developers and advertisers in 2025? Let’s find out!

Data source: This is a summary of the Casual Gaming Apps Report by Liftoff.

Note: Liftoff defined casual games as puzzle, lifestyle, and simulation games.

The Advertiser’s Challenge: Finding Value Amidst Volatility

Even with wavering consumer spending, mobile ad revenue hasn’t lost its momentum. Emarketer’s data suggests a promising 10% growth in US mobile gaming ad spend, touching the $6.28 billion mark in 2023.

And the trajectory? A steady 8-10% growth in the subsequent years.

Decoding the Casual Mobile Game Market Metrics: CPI and ROAS

Casual Mobile Games Market CPI Insights

From 2022 to 2023, the casual games market saw an average CPI of around $1, a drop from previous years. Post-ATT, Android was more cost-effective for casual games with a CPI of $0.63. In contrast, iOS’s $2.23 per install price tag is a stark reminder of platform disparities.

ROAS: The Advertiser’s North Star

ROAS remains the gold standard for finding out how successful your ad spend strategy is.

Casual games reported a 7.6% D7 ROAS, when taking into consideration both platforms. Interestingly, while Android users come cheaper, both platforms have comparable D7 ROAS figures. iOS edges out slightly with a 7.8% return.

Seasonal CPI and ROAS Trends for the Casual Mobile Games Market

2022 began with a low CPI of $0.61 in February, saw a spike in May, and then stabilized around $1.

On the ROAS front, returns peaked at 9.34% in July, with December seeing another surge, likely due to the holiday season.

Regional Metrics: A Global Perspective

Different regions, different stories.

As expected, North America leads in CPI, while Latin America offers the most cost-effective installs. Interestingly, while North America has the highest CPI, it also boasts the top D7 ROAS.

Genre-Based Analysis

Simulation games offer the best bang for the buck when it comes to user acquisition ($0.59).

However, when it comes to D7 ROAS, simulation and lifestyle games are neck and neck (8.5% and 8.3%), with puzzle games trailing slightly behind (6.9%).

Install Sources

Casual games are the dominant source of installs, accounting for a whopping 86.9%. Sports & driving games, though distant, secure the second spot at 6.6%.

Casual games, unsurprisingly, drive most installs for their category. But they also significantly influence other categories, with 74.7% of mid-core installs originating from casual game ads.

Genre & Subgenre Install Dynamics

Casual genres, especially hyper-casual games, lead the pack in driving installs across all genres.

However, advertisers need to be wary.

A narrow focus might mean missed opportunities. Broadening appeal can maximize reach, especially as players are often into multiple genres and subgenres.

Casual Games Market Trends for 2023

Here’s a short summary of the most important casual games market trends you need to be aware of in 2023.

Integrating Merge Mechanics

Merge games, with their drag-and-merge mechanics, are ranking high. Their simplicity, combined with instant gratification, makes them a hit.

Big titles like Homescapes and Gardenscapes are integrating merge mechanics, and even mid-core developers are jumping on the bandwagon. Games like Merge Vikings and Merge Stories are pushing the boundaries, blending merge mechanics with midcore mechanics.

Blending Subgenres and Adding Meta-Layers

Innovative game mechanics can be a game-changer. Fiona’s Farm, for instance, melds match 3, tycoon/crafting, and adventure elements.

This type of combination not only enhances the game’s appeal but also opens up diverse monetization avenues.

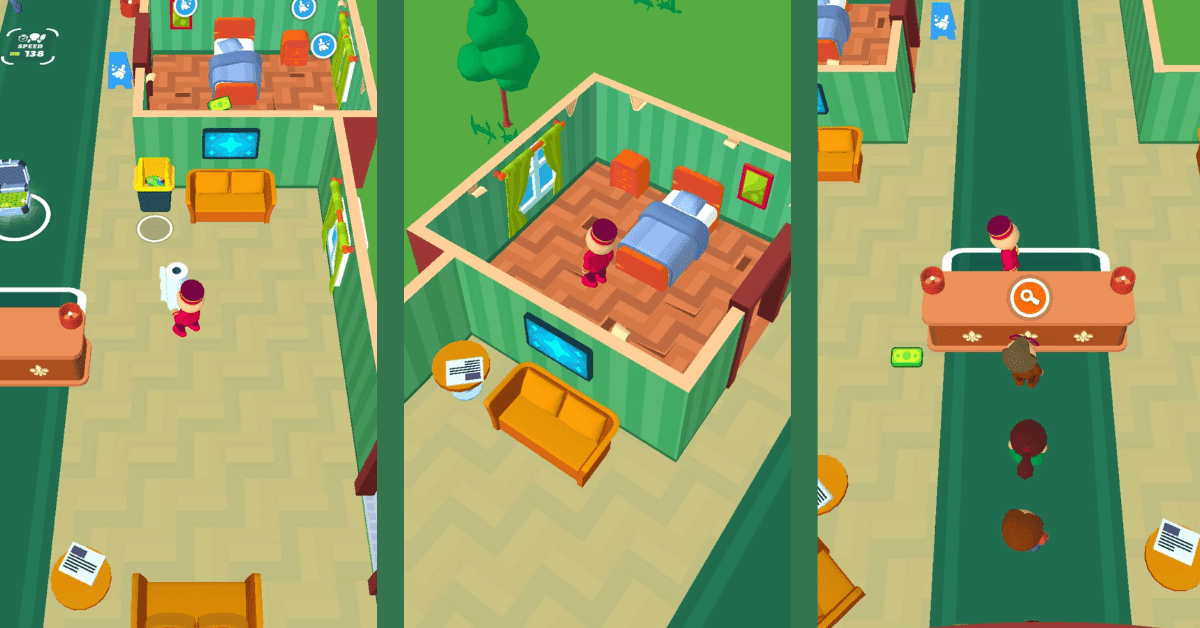

From Hyper-Casual to Hybrid Casual

The hyper-casual genre, once a dominant force, has seen a decline in market share.

The rise of hybrid casual games, like Voodoo’s Mob Control, is evident. These games blend elements from both hyper-casual and mid-core genres, offering a fresh gaming experience.

Mob Control, for instance, combines PvP elements with character card-collecting meta, striking a balance between IAA and IAP monetization.

Learn more about developing hybrid games in my Guide for Creating Hybrid Casual Games.

Standing Out with Innovative Core Gameplay

Puzzle games, a staple in the casual games market, are evolving.

Games like Match3D, Zen Match, and Triple Match 3D are redefining the genre with their unique core gameplay. Triple Match 3D, for example, offers a blend of hyper-casual gameplay with elements from other games, setting it apart from the competition.

Gaining a Competitive Edge with Events

Competitive events, once an oddity in casual games, are now mainstream.

Solo tournaments have become a must-have for any ambitious casual game. The popularity of these events stems from the innate human desire to compete.

Top-performing games like Royal Match cater to this competitive spirit, giving them an edge in the market. Learn more about this successful game in my Royal Match dissection.

Utilizing Mini-games

Mini-games are taking the casual games market by storm. From being mere UA creatives to evolving into permanent game modes, mini-games are redefining how players engage with games. Whether it’s through events or permanent modes, varying core gameplay through mini-games is a trend that’s here to stay.

Casual Games Market in 2023: A Summary

2023 marks a pivotal chapter in the casual gaming narrative.

With the rise of hybrid games, the evolution of core gameplay, and the integration of competitive elements, the industry is undergoing a big transformation. Merge games and mini-games are redefining player engagement, while innovative blending of subgenres is opening up new horizons for developers and players alike.

Comments